What is tax classification ?

There are different kinds of taxes that are relevant for SD. The fundamental tax type that SD consultants need to worry abt is Sales Tax. There might also be further variations in Sales tax like VAT , state sales tax etc.

The basic premise for taxation is at the material and customer level. Certian materials might be tax-exempt. Certian customers might be tax-exempt(eg. resellers). Certian customers/materials might be partially taxable or with low-tax rates.

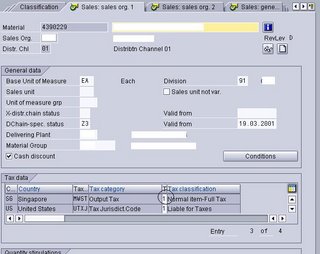

The tax category of the customer and material are set respectively in the customer/material master.

- Tax categories in Customer master

- The typical examples of tax classification are as 0- tax-exempt , 1- liable to taxes, etc

- The tax classification as computed in pricing(tax condition types with classification D or E)

- Tax Categories in Material master

- The customers tax classification is trickled down to the sales document in the following order.

- Payer (if different from sold-to)

- Ship-to (if maintained)

- sold-to (if not maintained in ship-to)

- The material tax classification is straight forward.

- Tax classifications are also maintained at Country/Region(state) level.

So for example UTXJ tax condition type is based on the above combination of customer/material/country/region tax classifications.

2 comments:

I really appreciate information shared above. It’s of great help. If someone want to learn Online (Virtual) instructor led live training in SAP SD , kindly Contact GRONYSA

Click for SAP SD Course details SAP SD

GRONYSA Offer World Class Virtual Instructor led training on SAP SD. We have industry expert trainer. We provide Training Material and Software Support. GRONYSA has successfully conducted 10,000 + trainings in India, USA, UK, Australlia, Switzerland, Qatar, Saudi Arabia, Bangladesh, Bahrain and UAE etc.

For Demo Contact us.

Nitesh Kumar

GRONYSA

E-mail: nitesh.kumar@gronysa.com

Ph: +91-9632072659/ +1-2142700660

www.GRONYSA.com

Hi!!

It is explicitly blog given accomplish information about SAP we are offering SAP MM TRAINING in hyderabad it is the best institute to module future.

Post a Comment